When we last checked-in on our man Terence Kevin O’Leary over seven months ago, he was nursing a pair of black eyes resulting from his initial FTX crypto shill, which had been followed by a tone deaf, but full-throated, defence of the company’s slimy founder, Sam Bankman-Fried (see prior post “America discovers the mirage that is Kevin O'Leary's investment prowess” April 2-23).

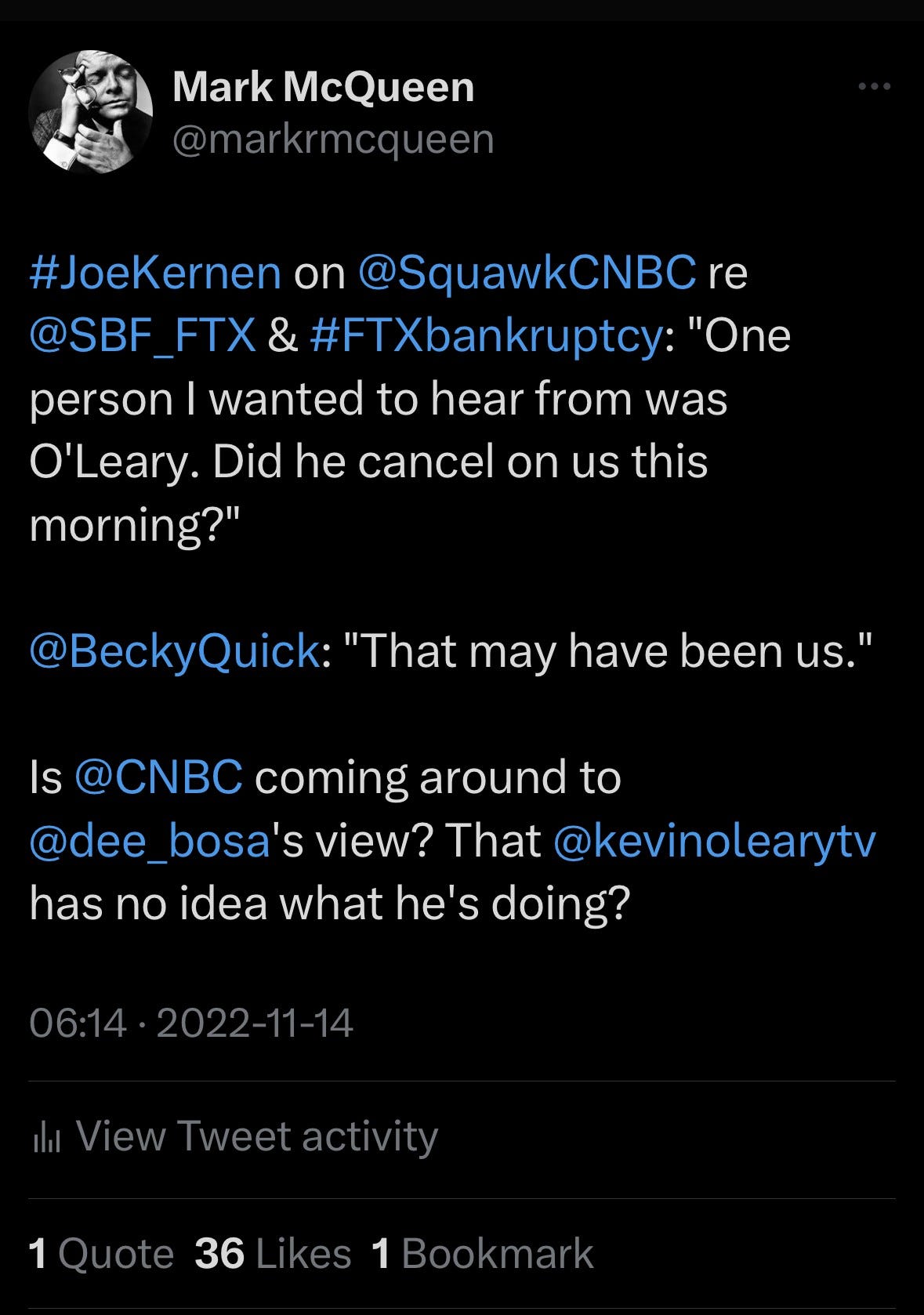

The reputation rehab tour that followed the FTX debacle has required KO to invest precious time with anyone who would give him airtime, including Yahoo Finance and Fox Business. I don’t doubt that it’s working, if one’s starting point is that any coverage is good coverage. Our man might be a suspect investor, but he’s certainly an accomplished self-promoter (see prior post “When it comes to marketing at least, Kevin O'Leary knows what he's doing” Aug 13-14). For those with a keen eye, there was a hint of potential trouble at CNBC almost a year ago:

That the unlicenced Mr. O’Leary was ever able to squeeze himself onto Wall Street’s premiere television stage was always a shock to me. An oblivious CBC was one thing, but a show based at the NASDAQ? KO’s regular Squawk Box guest spots made a bit more sense later, once CNBC acquired the re-run rights to ABC’s Shark Tank. Cross-promotion is a natural tool to drive awareness and viewership, and it was tough to fault CNBC’s production team for adding our man to the occasional morning or lunch-time spot.

I take no pleasure in reporting this, but KO’s new focus on the Fox TV network seems to have come of the heels of his apparent banishment from CNBC’s premiere show Squawk Box around the end of 2022. Correct me if I’m wrong, but the Squawk team appears to have finally twigged to the fact that the Emperor of Financial Analysis is without clothes. I might have missed him on air with Chief Tormentor Joe Kernen et al over the course of the last ~11 months, but KO seems to have been dropped from the list of regular early morning guests following his back-to-back (here and here) embarrassing appearances in December 2022 (Ed note: trainwreck?), where he defended both his FTX due diligence and earlier vow that he’d invest in SBF again — despite the previously-announced fraud charges.

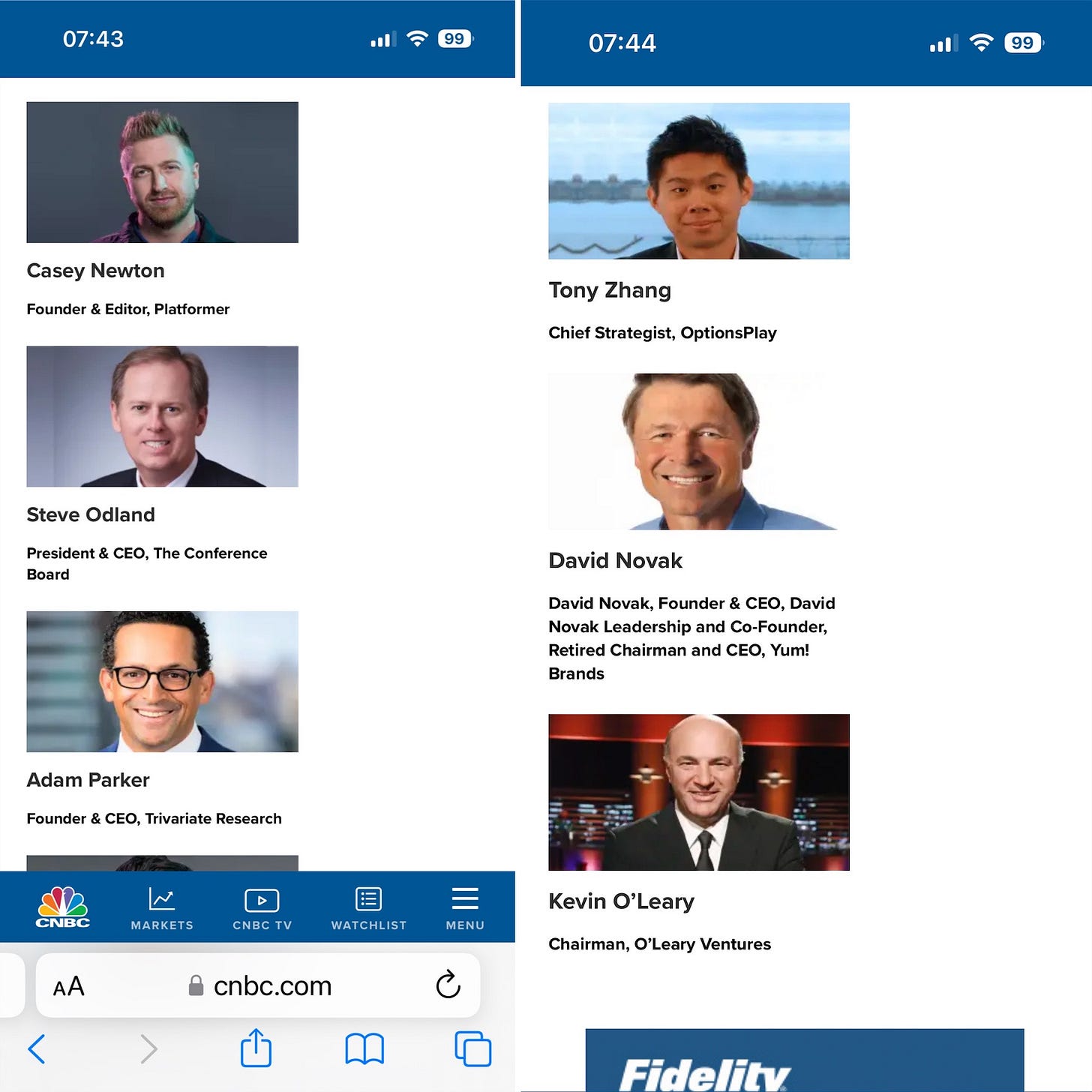

That KO never had any professional financial training in the first place was not news to Canadian bloggers (see representative prior post from 2008: “O'Leary ditches the "Get Paid While You Wait" cliche” June 1-08). That didn’t seem to matter much to CNBC Producers back in the day, who for years have listed KO on their website as a “CNBC Contributor,” along with many highly respected regular guests, including former Dallas Fed Chair Richard Fisher and former SEC Chair Jay Clayton. That marquee “Contributor” role may also be on thin ice, as Mr. O’Leary’s name/photo/bio (including his University of Waterloo B.A. in Environmental Studies and Psychology) is listed dead last (vs. alphabetically) of the 90 different official contributors cited on the website.

It’s not as though I didn’t warn them back in a 2014-era blog:

If you ever watch CNBC, you’ll have noticed that Mr. O’Leary has become a quasi-regular market commentator of late; when he does double-enders, O’Leary Funds logos float behind his head. No chance is missed to market his fund company, despite its performance (see representative prior post “Shed a tear for O’Leary’s Yield Advantaged Convertible Debenture IPO investors” Mar 24-13). CNBC sees KO on Shark Tank, hears about the $4 billion sale to Mattel, and assumes he’s a business guru.

Which leads to further marketing opportunities. On July 22nd, the CNBC show anchor asked KO what he was doing with “your funds” based upon Mr. O’Leary’s belief that interest rates would be rising sooner than expected. Mr. O’Leary responded:

“I have shortened the duration in my funds” “to 36 months”.

According to the current disclosure documents for O’Leary Funds on SEDAR, such as those dated June 18, 2014, Stanton Asset Management Inc. is the Portfolio Advisor to the O’Leary Funds and “manages the investment portfolio of each of the Funds.” To my knowledge, Mr. O’Leary has no accreditation to actively manage investment capital in any Province in Canada.

As such, there is no way that he is in a position to shorten the duration of the funds being managed by Stanton. Mr. O’Leary is not employed by Stanton, and is never referred to as member of the team performing the Portfolio Advisor role for O’Leary Funds. Quite the contrary, as one recent Prospectus discloses.

That said, I did catch a glimpse of him a few days ago on the newish 7:00 pm CNBC production called “Last Call.” For the new show’s fiery host, Brian Sullivan, it might make some sense; our man will provide his expert advice on whatever the hot topic might be that day. The irony of KO moving from CNBC’s market-moving 6-9am window to the network’s final live stop in the production day speaks volumes.

Down, but not out!

MRM

(this post, like all blogs, is an Opinion Piece reflecting a personal view)

Where are the regulators?

We love reading and hearing about Kevin O'Leary's antics.