America discovers the mirage that is Kevin O'Leary's investment prowess

"Be careful when you f**k with people's bank accounts."

It feels like only yesterday when The Daily Show was cited as a key source of “U.S. political news and information” for the under-30 crowd, so it took some guts for our man Terence Kevin O’Leary to take his “Reputation Repair”™ media tour to a challenging forum that’s unlikely to bow down to his faux-billionaire presence.

His host came well-prepared, and despite KO’s decades of live TV experience, he had no retort when Hasan Minhaj got to the core of my 15+ year point: providing entertainment isn’t the same thing as serving-up trained investment advice to the public:

The impetus of the appearance with Mr. Minhaj started some weeks ago, with KO’s pronouncement that he’d back Sam Bankman-Fried “again” — despite SBF’s leading role in the downfall of FTX. KO broke this news on the “Crypto Banter” YouTube channel, declaring that SBF was a “brilliant trader,” which KO said was sufficient him to look beyond what might turn out to be one of the biggest financial frauds of all-time. That was November 15th. It was an unqualified statement, and it was “on brand.”

Given that thousands of retail investors are at risk of losing a fortune due to SBF’s alleged criminal malfeasance, the #crypto internet exploded. KO’s brash statement confirmed two things that might have been news to many who’ve not been following along for the past 20 years: i) Mr. O’Leary is more interested in money than the morality of his entrepreneurs, and ii) KO has no one to blame but himself for his terrible investment track record.

The social media blowback was so fierce that KO did something very unlike him: he changed his tune. During a subsequent CNBC appearance on Dec. 8th, he told anchor Becky Quick that he’d finance SBF again — provided that he wasn’t convicted of a crime. This was a deft revision to the untenable spot that he’d put himself in earlier, and it didn’t seem as though any of the three fabulous Squawk Box hosts (Ms. Quick, plus Joe Kernan and Andrew Ross Sorkin) were aware that KO had only recently converted to that fundamental investor ethos that has served me well on Bay Street: don’t back criminals.

One has to hope that the FTX debacle, and KO’s clear absence of any due diligence beyond “look, his parents are compliance lawyers,” was the moment that CNBC’s anchors and producers were finally forced to reflect on whether or not Mr. O’Leary was actually worthy of their forum. (In the Time Magazine tradition of female whistleblowers, CNBC’s TechCheck Anchor Deirdre Bosa is the one to credit for asking KO the first tough questions about his own role in the debacle, just days after FTX hit the wall.)

Both Andrew Ross Sorkin and Joe Kernan pressed KO during the live Dec. 8th hit as to why he reversed himself on Bitcoin, having originally declared that it was “rat poison” and “garbage” when the virtual coin it was trading at US$8,000, only to declare it a good investment (also on CNBC) in the fall of 2021 as it hit US$65,000. Mr. Kernan teased KO about always being so sure of something, whether or not he actually knew what he was talking about. He then went in for the kill, directly connecting Mr. O’Leary’s US$15 million FTX payment with his change of heart about Bitcoin being “speculative garbage.”

That Mr. O’Leary’s very public support of FTX may have helped its management team commit their fraud against thousands of small investors appears to be a watershed moment for American commentators beyond the world of Wall Street, such as Mr. Minhaj. In the days and weeks that have passed since the Daily Show drubbing, KO has branched out, doing Fox Business News and Yahoo Finance TV at each and every opportunity. Time will tell if that’s because the A-Team at CNBC’s Squawk Box have discovered that the “Emperor Has No Clothes” and have cutback KO’s airtime (CNBC’s partnership with ABC’s SharkTank must make that sticky), but perhaps this is the same pattern we saw in Canada when Mr. O’Leary bounced around from BNN to CBC to CTV.

You can be sure that KO recognizes the damage that’s been done to his brand via the FTX scandal, and his hope must be that if he keeps doing TV hits on the topic of the day, that fact that he’s been found, once again, to be an empty suit on the investment front will fade. I’ve always given KO credit for his marketing chops (see “When it comes to marketing at least, Kevin O'Leary knows what he's doing” Aug 13-14 ), and he’s only improved his craft in the years that have passed since I penned that post.

All one can say to the American investors who’ve suffered financial losses by taking KO’s advice is “welcome to Canada’s lived-experience.” And, for fear that you think this is Mr. O’Leary’s first blemish with the investing public, I can offer a plethora of material that eviscerates that view:

O'Leary ETFs already under-performing (Feb 18-17)

“You might be able to hide from your track record, but you can’t hide from incompetence.”

Do O'Leary's "Low Risk" retail investors know they're long junk bonds? (Apr 26-14)

“According to O’Leary’s website, this fund is for investors with ‘low’ risk tolerance — the most conservative designation available according to Regulators. Remarkable: 91% of your bond assets are below investment grade….”

Kevin O'Leary closes failed mortgage startup (April 14-14)

“As retail investors continue to suffer via some of his lagging mutual funds, Kevin O’Leary’s brand took another hit last month when he agreed to “surrender” his mortgage licence to provincial regulators.”

Shed a tear for O'Leary's Yield Advantaged Convertible Debenture IPO investors (Mar 24-13)

“When the benchmark index is up 13.4% in a year, and fund investors are down 10% on their original IPO investment in the short space of two, all you can do is shed a tear for O’Leary’s convert investors.”

24 of 25 O'Leary Funds lost money in 2011 (May 27-12)

“For the life of me, I can’t figure out how Mr. O’Leary could pull this feat off. All but one of his bond funds was in the red, despite the fact that the bond market was on fire in 2011 — with the DEX Bond Universe up 9.7%.”

O'Leary fact watch: a 1990 Latour trades for $5,000? (Oct 17-11)

“The 1990 vintage was a fabulous year for the high end French wine makers, so our man is right to have one on hand to impress lanky TV anchors. If you’re not very good at math, Christies estimates this case of wine might go as high as US$10k. By the back of my envelope, that would put a bottle of 1990 Latour at US$833.33 per (plus hammer premium, duties and shipping from NYC). If KO actually paid $300 for the bottle, he’s done just fine if he can find someone to take it off his hands at that price. But $5K each? What was he thinking?”

O'Leary: "We have never dipped into the principal" (June 7-11)

“Almost $4.5 million of distributions were made over the two full fiscal years, despite a substantial loss. Where, oh Dragon, did that capital come from if not from dipping into Principal?”

High MER a surprise at O'Leary's OGE Fund (April 16-09)

“As the fund launched its IPO last summer, one should not be surprised at the higher than anticipated total management expense ratio (MER). But the MER excluding IPO expenses, at 3.52%, is a far cry from the ‘low’ 1.5% level that Mr. O’Leary promised last summer.”

O'Leary "Global" Equity fund loads up on old Canadian favourites (Feb 13-09)

“The six top stock positions are Canadian-based securities. Not to put too fine a point on it, but weren’t we promised ‘that global investment opportunities provide investors with an important source of investment diversification, income and appreciation?’ Canada represents just 3% of the world’s stock market capitalization. The USA’s GDP is 11x our own, yet none of the ten largest holdings comes from the world’s largest stock market.”

O'Leary Fund promises to share the wealth and wisdom (May 8-08)

“Until Mr. O’Leary matches Eric Sprott’s IPO disclosure and gives investors the details of his personal investing prowess since 2000, none of which is disclosed in the O’Leary Fund IPO prospectus, we are left to wonder why this is the right vehicle for the times.

At noon today, Toronto investors will have their chance to find out, first hand, why this is a sensible vehicle for their needs. KO will wow the crowd, that is assured. The proof will be in the pudding once the Funds’ investment returns are published a year or two from now.”

Prior to CIBC’s acquisition of Wellington Financial LP in January 2018, I wrote more than 1,000 blogs. Topics ranged from the venture market to public policy to corporate governance and anything else where I thought I could add to the public’s appreciation of XYZ issue. Big or small as they may be (the issue, not the size of the investment account impacted).

Some of my highest profile research related to Mr. O’Leary, once the mainstream media poured through my posts and advanced the cause with their own independent research regarding KO’s questionable business track record.

Through no fault of my own, I came across him when I joined a particular TSX Board in 2003, meaning that I was exposed to Mr. O’Leary long before he became a television figure. Sad! Of those 1,000+ blog posts, fewer than 7% touched on KO over the course of more than 12 years or writing (2006-2018). He was good fodder during a time when my readers had very high expectations on the publishing cadence front, but there’s no obsession. My central point, as penned in 2008, is simple:

Investors and their financial advisors might make a some good Alpha from Mr. O’Leary’s proposed fund. And they’ll certainly get a kick out of his TV persona, if that’s their thing. Even an invite to his Lake Joseph cottage if they place enough Units.

But if retail investors are looking for a superstar to manage their investments, there are plenty of people out there with established track records, through bear and bull markets, recessions and expansion economies. Warren Buffet (BRK.B:NYSE), Hal and Duncan Jackman (ELF:TSX, UNC:TSX, EVT:TSX), and the Desmarais Family (POW:TSX) are but three that come to mind.

As a believer in the “been there, done that” mantra, I’ve been reluctant to go back to the “O’Leary well” with the launch of this new blogging era following my half-decade plus “hiatus” (H/T JB) while at CIBC. That said, the American journalists and opinion leaders who are now starting to discover that KO is neither a trained nor particularly successful investment manager are walking the same path of discovery that their Canadian confreres did over a decade ago.

This post is meant to save those folks some time in their important and necessary journey.

MRM

(this post, like all blogs, is an Opinion Piece)

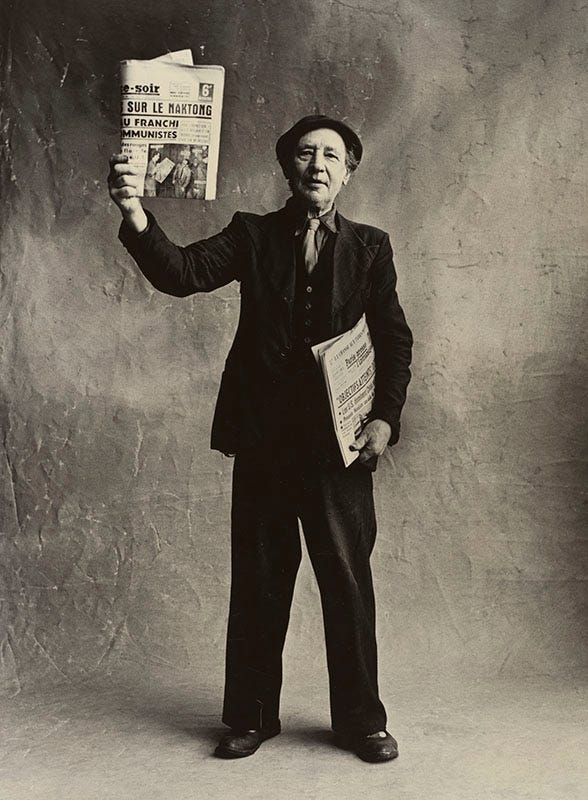

(Marchand de journaux, Paris, 1950, by Irving Penn)