Will the CSA succumb to overstated sustainability reporting "risks"?

News report: "Risks loom as sustainability reporting timeline lags"

My current office desk might be a thousand yards further from Bay Street than normal, but one thing is clear to me despite the distance: new domestic regulations around “sustainability reporting” will have no material bearing on a Canadian growth company’s ability to access capital anywhere in the world. Anyone who tells you otherwise is reading from a memo prepared by people whose livelihoods depend on writing memos.

“They’re eating it up in Europe” was one of the late Ross McMaster’s favourite pat responses when a Canadian Portfolio Manager would ask how a company’s equity roadshow was going. For generations, Canadian investment bankers have taken a select subset of their clients on marketing roadshows to cities such as Basel, Frankfurt, London and Zurich in the hopes of snagging a $5 or $20 million order from some 200 year-old money management firm. It will be a Life Science deal one week, and an Oil and Gas play the next. The meetings are always polite, but it is a rare occasion when even a single European order is placed on a Canadian small-mid cap equity offering; invariably, the book lives or dies based on the support of local money managers, along with the U.S. firms (such as Fido) who have a mandate for investing north of the 49th parallel.

A talented Institutional Salesperson might get a U.S. Hedgie to play on a deal with a warrant, but it takes something like a wildly-successful US$1 billion offering from Research In Motion (Jan. 2004) to lure a gaggle of Euro PMs to the party. Those are very rare moments in time. Over the past 25 years, there certainly have been anomalies, such as the flash-in-the-pan FTSE AIM market (see representative prior post “Bizarro AIMo” Jan 25-07) or the gaming craze, when Canadian-based firms found Europe to be temporarily welcoming. Each and every time, however, the market door has closed as quickly as it had opened.

This harsh reality flies in the face of the “worries among experts that any further delay” around “making sustainability-reporting mandatory…puts [Canada] at a competitive disadvantage….” There may be a specific rationale for a CEO to want to voluntarily disclose climate-specific risks, but the allure of “attracting capital” should not be on the list of valid reasons for the Canadian Securities Administrators to embrace new rules — in the absence of specific U.S. legislation — around enhanced sustainability reporting standards.

For a TSX 60 member company, each will have it’s own decision-making process. Firms that have already sold “Green Bonds,” such as Telus (T:TSX), may want a third party to validate that they’re tracking against their quasi-binding sustainability promises — despite the fact that existing Securities legislation requires that they provide investors with “Full, True and Plain” disclosure. If a publicly-listed firm gets caught “green-washing” tomorrow, I’m sure a Commercial Litigator will have a field day, regardless of what memo was prepared that validated the math behind the effective interest rate of a “Green Bond.”

For large-cap names, such as TC Energy (TRP:TSX) or the Big 6 Canadian banks, their Investor Relations teams know exactly what European shareholders and prospects are looking for — they’ve been in direct dialogue for years. If TC Energy believes their access to capital will be improved by adopting an approach recommended by the International Sustainability Standards Board, the TC Energy Board of Directors can pass a motion at the next Board meeting. There’s no reason — nor benefit — to wait for the CSA to adopt something “tailored to the Canadian economy.” In fact, one could argue that we should reject any rules that are “tailored” for an energy-producing economy as they may not meet the expectations of the very global investors already backing the ISSB.

If the argument is that Canadian investors and legislators should be worried about “deceptive practices” on the part of the TSX 60, I’d like global regulators to spend more time looking at the disclosure reports of Chinese-listed property firms before they fuss about the fact that RBC lends (Ed. note: Thankfully) to Canadian energy producers and infrastructure companies. Whatever RBC does on the climate disclosure front won’t satisfy an advocacy group that’s trying to shut down Canada’s oil and gas industry. We shouldn’t pretend otherwise.

I’m all for voluntary adoption of whatever global standard might help a Canadian firm realize its full potential. But to force every public company to spend tens of thousands of shareholder dollars annually on new domestic certifications will serve no one more than the accounting firms that are encouraging this “mandatory reporting.” New disclosure rules certainly won’t pry open the tap of the European equity markets.

MRM

(this post, like all blogs, is an Opinion Piece)

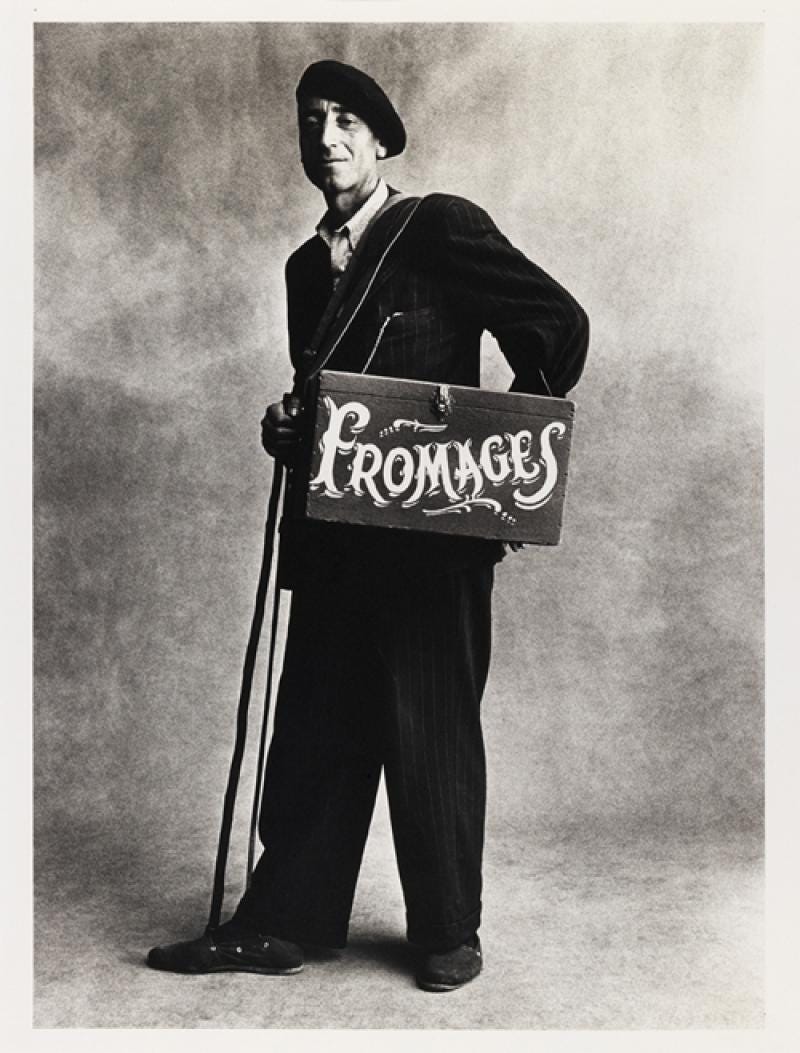

(photo: Chevrier, Paris 1950, by Irving Penn)

absolutely true !

CSA has already succumbed to the overstated.