Why does Ottawa rank a steelworker higher than a software engineer?

News report: Algoma Steel seeking cheap $600M federal loan

Every entrepreneur knows there’s an inherent risk in starting and growing a business. You have an idea, develop a protype, raise a bit of capital, hire some folks and work your tail off in the hopes that you can successfully navigate the daily obstacles.

Competition, your ability to hire and retain the right talent, resource management, regulatory changes, customer demand, suppliers, margins, market shifts, availability of capital, your own shortcomings…. The list of known obstacles is almost endless, and the themes are the same across every business sector.

As a case in point, an experienced CEO by the name of Jason Smith had to recently “slash” 40% of his company’s workforce “amid increasing uncertainty as to what companies are willing to pay for versus building themselves in the age of AI” (H/T Betakit). Vancouver-based Klue has been around awhile, and it’s not Mr. Smith’s first rodeo, so this wasn’t a function of sloppy management during the early phase of a company’s growth. The impact of AI is real, even if it wasn’t foreseeable a decade ago when the company was formed.

Over at the Hudson’s Bay Company, founded in 1670, 8,300 employees were given pink slips earlier this Spring when that historic brand fell into Receivership. As unsecured creditors, HBC employees didn’t get severance, although they may be able to access a Federal program by the name of WEPP in the amount of seven weeks’ maximum insurance earnings under the EI Act. Seems fair — workers and employers pay into the EI fund for such “just in case” moments.

How quickly Klue or HBC employees find new work will be a function of a bunch of things, but these two examples come to mind as I read the daily machinations around Algoma Steel (ASTL:TSX) as scooped in one of my morning newspapers.

In what appears to have been a well-organized 1-2 Comms punch, Sault Ste. Marie-based Algoma Steel is reported to be in discussions with the government of Prime Minister Mark Carney about a $600 million “financing package” as “financial pressures mount during a trade war with the United States.”

It may not be news to you that U.S. President Donald Trump imposed 25% tariffs on global steel imports earlier this year, or that he “doubled the tariff to 50 per cent last month, which essentially closed the American market entirely to Canadian steel makers.” Whether that was about China using Canada as a convenient transshipment partner for that country’s excess steel production, or President Trump trying to move Steelworker jobs to Pennsylvania, the challenge presented to executives at Algoma Steel, Dofasco and Stelco is real. Plus their suppliers and the balance of the ecosystem that calls these three firms a client.

What might be news is that this is your problem as a taxpayer, unlike the travails of Klue or HBC.

According to the Globe’s reporting, Algoma:

[wants to] secure between $400-million and $600-million in loans to help keep it afloat over the medium term. The package could also eventually see the government purchase an equity stake in Algoma.

Ottawa recently changed its rules, allowing it to hold equity in companies under the Canada Enterprise Emergency Funding Corporation (CDEV). The Crown corporation was set up in 2020 to fund companies reeling from the COVID-19 pandemic. It was directed in March to do the same for those affected by the trade war under the Large Enterprise Tariff Loan (LETL) facility.

From a bureaucratic convenience standpoint, I can see why the Feds might want to use mechanisms created during the Covid-19 era to solve tariff-related business problems. The company employs 2,800 and 60% of the work force makes more than $100k. To say it’s important to the local community is an understatement; but this isn’t a once-in-a-100 year pandemic.

It falls neatly into the “shit happens” bucket, even if that workforce deserves extra attention if only because of the brave soul who took it upon himself last year to explain to then Prime Minister Justin Trudeau that his new national dental program was counterproductive as it only served to reward his “lazy” neighbour. The one who sat on her couch all day while he worked to pay for his family’s dental coverage every two weeks out of his own pocket via payroll deductions.

That said, Algoma management may have some work to do to convince taxpayers that public investors deserve a Federal bailout merely because President Trump decided to focus on steel (possibly prompted by dumping by China, Turkey, South Korea, Malaysia and Vietnam), instead of the Lobster fishery, for example. Or life science firms.

The second volley of the media attack came via a well-crafted interview the next day with an Algoma shareholder by the name Barry Zekelman, who told Niall McGee that Ottawa was “acting like a ‘loan shark’ over emergency funding.”

Apparently, “the loan terms are extremely onerous, including exorbitant interest rates, high fees and a provision that could allow Ottawa to purchase stock in Algoma at very low prices,” according to Algoma’s CEO, Michael Garcia. Company shares fell from ~$9.40 to $8.20 as the market digested these daily media leaks.

Mr. Zekelman, who runs a Chicago-based steel and pipe tube maker and bought 5% of Algoma last year (shares traded between between $9.20 - $16.83 in 2024), doesn’t like what he sees from a government run by a former Goldman investment banker:

“I’ve seen some of the numbers the government wants. I mean we’re talking about saving an industry here. It’s ridiculous.”

Finance Minister François-Philippe Champagne wants us to know that his Department is in daily discussions with the industry, and that “this work remains and is underpinned by one goal: protecting our industry and the many Canadian workers who are helping build Canada strong.”

I can see why the company’s Board might not like any financing proposal that’s “pretty dilutive to the shareholders of Algoma,” but that’s the nature of the beast, no? A bad macro will invariably punish publicly-traded shares.

How many of the 592 equity financings closed by Canada’s tech, clean tech and life science entrepreneurs last year were done at valuations that weren’t negatively impacted by external forces? Forces that were beyond the control of the staff and shareholders of the companies in question? Through no fault of their own.

Does that make it worthy of government intervention?

Algoma could always do a rights offering if shareholders didn’t like the terms being offered by the Carney government. Or stop paying quarterly dividends until the future becomes a bit more clear — that would certainly bolster the balance sheet in the face of a tougher sales environment. As everyone in the venture space well knows, you always have the option of solving your own financial “problem” if you don’t like what the other guy/gal has tabled.

Part of Algoma’s pitch is that the company “is Canada’s last remaining independent primary steel maker. The other two steel makers that have sizable operations in Canada, ArcelorMittal Dofasco and Stelco, are both owned by foreign giants. Algoma is also the only Canadian manufacturer of steel plate used in the defence sector. It is transitioning to be a low-carbon emitter, and aiming to be the lowest-cost operator in Canada by the end of 2026. Our message to the government is Canada needs Algoma Steel.”

I worry that the problem is partly due to the perception of Ottawa as a plump pigeon, ready for the plucking.

According to the Globe, “Ottawa in the past has provided funding to the company at extremely favourable terms, and Mr. Garcia is pushing for a similar financing package now. The government loaned the company $200-million to build its new electric arc furnace. The loan is forgivable, if Algoma meets certain emissions standards over time. In addition, the government provided the company with a $130-million loan to modernize its plate mill, also at favourable terms.”

That Mr. Trudeau’s government gave away Federal dollars to help a company meet his Cabinet’s demand that industry transition away from carbon use is something that neither voters nor taxpayers can do much about at this stage.

What is up for discussion, however, is how “strategic” the steel, auto and aluminum industries are to Canada’s future. As compared to retail chains, software companies, and every other sector of the economy that is left to be buffeted by traditional market forces.

If preserving an independent domestic steel industry is fundamental to Canada’s economic future, why on God’s green earth did the Trudeau Cabinet, advised as the time by Mr. Carney, approve the takeover last October of Hamilton-based Stelco by Cleveland Cliffs, a foreign firm (see prior post “Jagmeet Singh, you need an issue voters can rally behind and I have just the thing” Sept 8-24)? That ship has now sailed, and with it departed any notion that either the Grits or the NDP care who owns our steel companies, or what their shares trade at.

No one would wish for these tariff negotiations to lead to material job losses in Sault Ste. Marie, but politicians will need to quickly figure out why certain classes of employees deserve more protection than others. Autoworkers but not software engineers. Steelworkers but not minimum wage folks in the kitchenware section at HBC’s former flagship store at Queen & Yonge.

There’s either a free market or there isn’t. Algoma Steel shareholders may want to grab this deal before the balance of Canadian workers figure out they’re the ones paying for this latest bailout.

MRM

(note: this post, like all blogs, is an Opinion Piece)

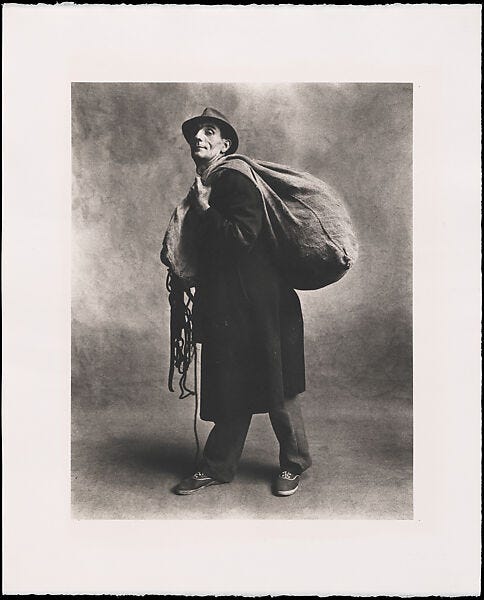

(photo credit: Rag and Bone Man, London, 1951 by Irving Penn)