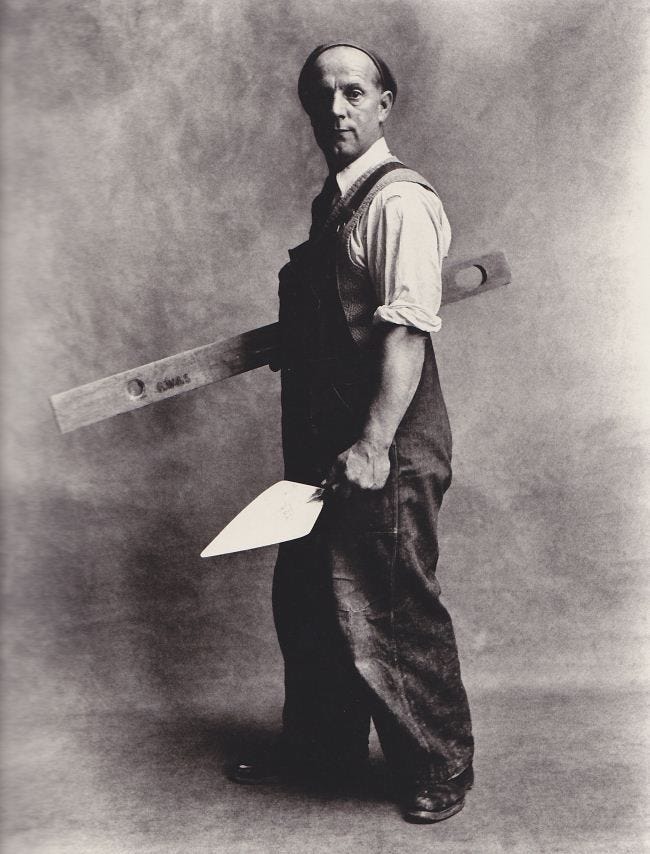

If he hadn’t left us far too early, the late Ross McMaster most certainly would’ve declared yesterday that “The casino is open.” The following excerpt is from the WSJ:

The enthusiasm is especially heated in a few areas, investors and bankers said. Banks and other financial companies climbed, with the KBW Bank Index rising 11%. Investors expect regulatory scrutiny will ease in a Trump administration.

Some also expect more dealmaking, potentially among smaller and midsize banks. The expected departure of Lina Khan, who leads the Federal Trade Commission and has been a thorn in the side of executives hoping to work out tech acquisitions, was cheered by investors and bankers.

“A lot of these mergers have been thwarted by the current administration,” the activist investor Carl Icahn said in an interview late Tuesday. Given a Trump victory, he said, “That’s going to change.”

As names like BofA, Wells and JPM were flying during the first few hours of Wednesday’s trading, Canadian bank investors didn’t quite know quite how to trade Donald Trump’s pending return to the White House. Now that the initial KBW Bank Index exuberance has worn off a snick, how should Canadian bank CEOs approach this watershed moment?

If you have the luxury of the freedom of movement, don’t stand around watching, I say.

When it comes to bolting on a meaty U.S. acquisition, I think that we can group Canadian bank stocks in three buckets:

Group A — the “Game On” group:

CIBC (CM:TSX), RBC (RY:TSX) & ScotiaBank (BNS:TSX)

Group B — the “Busy Right Now” group:

Bank of Montreal (BMO:TSX) & TD Bank (TD:TSX)

Group C — the “Stick to our Home Market” group:

National (NA:TSX)

In reverse order: I could have easily put National Bank into Group B given its pending $5.5 billion acquisition of Canadian Western Bank, but one has to think that the market’s expectation that National will continue to stay focused on its Canadian footprint is just as important. That said, given how successful the team has been over the past decade-plus (see prior post “Does ‘Courage’ create shareholder value?” Apr 22-24), institutional investors would likely give NA management the benefit of the doubt if they put their 12.3x eps and 1.7x book value multiples to work.

The stories at BMO and TD are starkly different, of course, but the end result is no deal.

TD is deep in the penalty box at absolutely the wrong time in the U.S. political cycle, and I can’t see why a change in the U.S. Administration will get the institution off the OCC’s naughty list. BMO is still somewhere along the journey of integrating last year’s massive Bank of the West deal, and if things were going fabulously well on the credit quality front, perhaps they could be credibly kicking the tires for a smaller tuck-under. That’s not yet the case, however, and OSFI will be in no mood to sit down with anyone from BMO’s “good ideas” club.

That leaves the Game On group:

CIBC shares are up >42% over the year, and with a book multiple in excess of 1.5x, the currency is primed for M&A for the first time since 2018. The bank’s big U.S. acquisition of The Private Bank was first launched almost a decade ago, and Trump’s 2016 election win drove regional bank shares so high that it took an extra year to renegotiate that deal. Unpleasant as that likely was, the American commercial and wealth markets remain a huge opportunity.

For the longest time, RBC has enjoyed the richest valuation of Canada’s Big 6 banks, and today is no different. That makes every potential deal just plain cheaper, and the success of the HSBC Canada integration process will give Team Leo confidence that they have a formula. For reasons I’ve never understood, the City National acquisition didn’t go as well as it could have, but that’s no reason to shy away from adding further U.S. heft asap.

ScotiaBank’s August announcement of a friendly 14.9% toehold in stake in KeyBank (KEY:NYSE) is already up ~12% in value, and perhaps that’s the only play the management team is prepared to make for the moment. However, if growth in far-flung foreign markets is off the table for all-time, the U.S. is the only obvious option.

Of the three “Game On” names, two are run by CEOs who’ve been in the chair for more than a decade. As such, both are at the back-end of their time at the helm — aka the very moment when you’re at the peak of your insight into your institution’s strengths and weaknesses. That either lends itself to i) launching a deal for the next generation of leaders to optimize, or ii) sitting tight, not breaking anything, and consolidating the stellar share price gains of the past 180 days.

If it were me, I’d at least want my Corp. Dev team to know what was going on at the following potential targets, among others:

Bank of California (BANC:NYSE) - US$2.7B market cap. - 1x book value

Comerica (CMA:NYSE) - US$9.3B market cap. - 1.2x book value

First Horizon (FHN:NYSE) - US$10.4B market cap. - 1.1x book value

Huntington (HBAN:Q) - US$25B market cap. - 1.3x book value

Regions (RF:NYSE) - US$24B market cap. - 1.4x book value

Western Alliance (WAL:NYSE) - US$10.6B market cap. - 1.3x book value

On the assumption that President-elect Trump will be able to get corporate tax rates down further, that’s great for every Canadian bank with meaningful U.S.-based earnings. Moreover, if the Journal’s reporting is correct, U.S. bank regulators will be as accepting of M&A ideas as they’re ever going to be over the next decade or two.

The mistake in bank M&A is never in the deal itself, it’s in being too hands-off, post-closing. That, and not pulling the trigger when you could.

MRM

(this post, like all blogs, is an Opinion Piece)

(note: our household owns many of the securities mentioned above)

(photo: Brick layer, London, 1950 by Irving Penn)

There will inevitably be some Canadian Bank or Financial institutional mergers—too many bankers and employees of banks. Canadian Banks are less profitable than some lean US and South American banks.