Stillborn CIC another blow to Canada's Innovation ecosystem

"Trying" isn't the same as "Succeeding"

The Grinch came early this year with the news that the $3+ billion Canadian Innovation Corporation will not see the light of day prior to the 2025 election. Whether or not this super agency was a good idea, none of us would disagree with the government’s stated rationale: “The Urgent Need to Address Low Business Investment in R&D.”

The CIC’s latest delay only compounds the difficulties that many early-stage Canadian firms are currently facing. It’s been months since the Liberal government froze the funding tap over conflict of interest allegations at Sustainable Development Technologies Canada, at the very moment entrepreneurial researchers should be able access a reliable funding partner as they try to solve the world’s carbon challenge, among others.

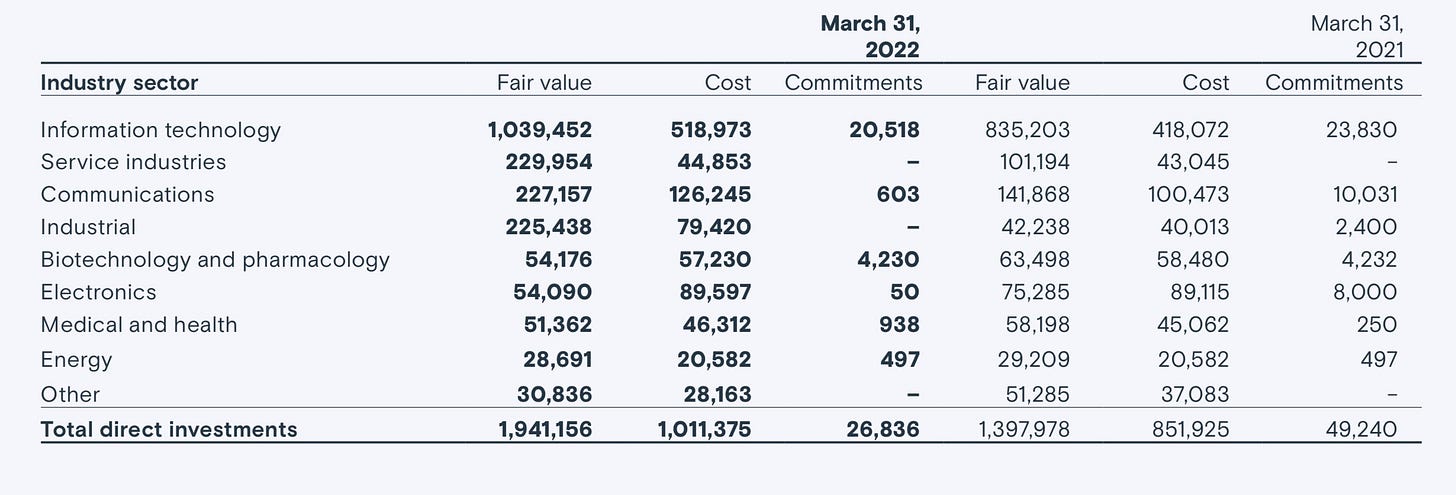

Add in the fact that only 4.5% of BDC’s $41.5 billion of deployed capital is directly invested in the innovation economy, setting aside the separate Industry Canada VCAP/VCCI allocation (see representative prior post (“Northleaf's Venture Catalyst Fund gets to work” Feb. 27-14), and it’s hard to believe that this is the picture that Ottawa has painted after eight years of feverish policy brush strokes.

(source: pg. 110, 2022 Business Development Bank of Canada Annual Report)

The CIC dye was undoubtedly cast when Michael Sabia departed following his second formal tour in Ottawa. So much of what I’ll call Ottawa’s 2020-22 strategic re-org (“Sabia will shake things up”) seemed to depend on his intestinal fortitude. That’s the key thing about getting stuff done in Ottawa. You need an idea, for sure. Funding, certainly; and add a dash of political cover, unless someone had previously laid out the necessary legislative authority. But so much of what goes into the equation is sheer intestinal fortitude.

Without that God-given gift, policy changes such as the FTA or the GST wouldn’t have stood a chance under the Mulroney government. We all recognize the opportunity for individual impact on the soccer pitch, in a lab, via an ink pen or a paint brush. Few appreciate how important (ed. note: necessary?) it can be in the Halls of Power, where there are always reasons to NOT DO something, either for political expediency purposes or because it’s just hard to fight the status quo with vested interests everywhere you turn.

The fact that CIC appears to have been shelved as quickly as it was stood up, along with the necessary re-org of the granting side of the National Research Council, can’t be explained away easily. I doubt the CIC’s original business case has diminished, or that the Liberal Party has lost it’s appetite to use debt-funded dollars to finance new growth initiatives. Could it be as simple as the absence of a key stakeholder such as Mr. Sabia to overcome the inertia that’s surely afoot when it comes to multi-decade business and research granting traditions in Ottawa?

It was only February 2023 when the government laid out the details of this new Crown Corporation — depicted as being of pressing need to improve the commercialization of Canada’s existing research spending budget. To postpone launch ten months later, just as you’re standing it up; it’s the only rational conclusion. If Mr. Sabia’s departure for Quebec Hydro in May wasn’t enough, the unfortunate mayhem at SDTC might also be a contributing factor — showing a flaw in the original CIC vision.

If you were one of the “five people” who apparently put my name forward to be either Board Chair or the inaugural CIC CEO, I truly appreciate the compliment, even if it wasn’t the perfect fit for me right now. An obvious challenge for any would-be CIC CEO was the reality that a well-travelled candidate is going to have a lot of pre-existing professional and personal relationships within the Canadian academic, entrepreneurial and venture capital communities. I’m not sure that the concept of the CIC’s new granting role squared well with the fact that a key success factor for any future CEO would be the very relationships that might later be thrown back in his/her face when these industry allies cashed their invariably-worthy federal funding cheques.

Is it a “conflict of interest” if I was to support CIC playing a role with an entrepreneur or venture lender that I previously worked with? Or perhaps recommended federal funding for a company backed by a Montreal-based VC that I’ve known for 20+ years? Are you in a conflict of interest if you get excited about a research opportunity that’s being conducted at your alma mater? How about if you’re a former member of that University’s Board of Governors? At what point does expertise and insight morph into blatant self-interest?

One man’s comfort in a deal because of who’s involved is another man’s “apparent conflict,” and that was obvious to me before SDTC’s troubles hit the headlines. With CIC staying on the shelf, Canadian entrepreneurs are the losers, once again, whatever the real story might be.

Venture funding figures coming out of Europe, the USA, even Israel, in 2023 will put further pressure on Ottawa to improve Canada’s access to risk capital. To give you a sense of just how serious the situation is, 20 U.S. States in the so-called “Heartland” were able to attract US$55 billion of venture capital investment in 2021, which was three times larger than a decade earlier (according to a recent Heartland Forward report). Forget about California, Massachussets and New York — we are talking about places such as Arkansas.

Why it matters: The [300% funding] jump means more startups in the 20-state region of the nation's midsection. New companies tend to spur clusters, or hubs, of related firms — creating more jobs, attracting talent and generating economic activity. from Axios

Here at home, Canadian entrepreneurs at 494 different firms raised ~C$5.4 billion over the first nine months of 2023, as compared to US$126 billion of venture capital into 11,935 deals across all of the USA during the same period. That Canadian figure is no where near close to the 1/12th that our relative GDP would imply; nor is it within spitting distance of even the 1/20th figure that we once were used to seeing.

There’s no “Canadian Heartland” per se, but I think it is fair to back out fundings in Ontario, Quebec, Alberta and B.C. for comparative purposes. YTD, six provinces raised ~C$253 million in aggregate — and while that’s far better than the C$111 million raised in 2011, it barely moves the needle of Canada’s economy. We are doing something wrong if a bunch of university-based research institutions aren’t able to generate anything worthy of potential commercialization, as tapping external venture capital investment would telegraph.

In Europe, Atomico estimates that entrepreneurs in that region will raise 18% more venture capital in 2023 as compared to 2020, despite the fact that both the USA and Rest of World will be slightly down on that same three-year metric. Canada’s 3-year percentage growth (2020-23) will be similar to Europe’s, but that’s only because 2020 was down 30% as compared to 2019’s dollars. Nothing to crow about.

It’s not that Canada’s Liberal government doesn’t want to grow this sector; I don’t doubt their enthusiasm one iota. It’s just that the zigging and zagging on the policy front isn’t creating a fundraising environment that gives our entrepreneurs a chance to keep up with their global competitors.

Something’s gotta give.

MRM

(this post, like all blogs, is an Opinion Piece)

(photo: Rempailleurs (A), Paris, 1950, by Irving Penn; copyright The Irving Penn Foundation)

So true.

Canada needs more R&D in the Pharma industry. The expertise is here and so are the people.