Some Canadian Billionaires aren't waiting for sanity to return

Whether there’s an election in March or October, the complexity of the deep-seeded challenges before the new government are hard to fathom.

There are rumours, urban myths, and then there’s stuff that you know to be absolutely true.

A few years ago, it was unusual for a youngish Canadian family to head-off for a tax-friendly jurisdiction, and I didn’t think much of it when Family XYZ made the choice. When Covid arrived, it was easy to explain-away why someone like ClearCo Co-CEO Michele Romanow might move to Barbados — remote work was all the rage, the weather was a plus, and the potential material tax benefit of getting ahead of a future VC up-round was undeniable.

More recently, the kinds of people who help build our hospitals and universities are making similar decisions — and we all should be deeply worried about i) what that means for the Canadian economy down-the-road, and ii) the message it sends to foreign-based ultra-wealthy families who have investments in Canada.

The one “departure” didn’t surprise, given the appeal of the social scene in Miami and how they like to spend their time. The second was disturbing given the particularly generous profile of the family involved. The third was bad news because they’d suddenly decided to end the cross-border USA/Canada lifestyle that had served them just fine for 10-15 years. The fourth and fifth undoubtedly thought that the international allure of London was irresistable.

None left for reasons of identifiable religious persecution post Oct 7th (distressing as the pointless protests are, see prior representative post “‘No Justice’ in Gaza means ‘No Peace’ in Toronto” March 29-24), and it’s not for any of us to judge the personal choices of anyone. That doesn’t mean that we shouldn’t worry that very successful people — the kind of individuals who built national or global businesses, created jobs for thousands, and paid plenty of taxes along the way — have permanently left town.

Although they may have retained a home in Rosedale, or a cabin somewhere in Alberta or B.C., it appears that in each case they’ve decided to pay their taxes somewhere else going forward.

In 2016, a certain senior Federal cabinet minister would get an occasional earful at Toronto cocktail parties or business roundtables. He’d share his view that successful folks had “to do a little bit more.” When someone pushed back on the notion that taxes weren’t already high enough, and explained the “eight year breakeven” of pulling-up stakes, paying their deemed disposition taxes and moving to (say) New York, the Minister would confidently respond: “you’re not going anywhere.”

He might have been right in the moment, but this federal government seems to have finally pushed many past their breaking point.

Every financially successful Canadian understands that they’re going to pay the vast majority of income taxes. According to a 2024 Fraser Institute study, the “top 20 per cent of income-earning families will pay nearly two-thirds (62.7%) of federal and provincial income taxes while earning less than half (46.4%) of total income. Comparatively, the bottom 20% of income-earning families will pay 0.8% of personal income taxes.”

There’s a sense that 40% of Canadians pay no “net tax,” when you take into account various tax credits. Add-in the cost of those who work for the public service, and the burden of paying for all that Canada offers falls on a relatively small cohort of honest taxpayers.

I’m not sure what gradually changed between 2016 and 2024, but very wealthy people who weren’t “fed-up” have suddenly decided to depart Canada for good. It’s not as though the local weather has changed for the worse, and these five Billionaires wouldn’t likely even know each other.

Each appears to have independently decided that they were prepared to pre-pay their unrealized capital gains taxes and start fresh elsewhere. Although the Canadian treasury got a short term benefit from those lump sum cheques, whatever wealth and jobs that will be created in the decades to come from that remaining pool of assets will be for the benefit of some other nation.

All of this is their personal business, and they certainly earned the right to fly-off to other lands — whatever the driver may have been. And while they might miss us, I doubt they’d be regretting their decisions if they had occasion to read either of these post-Christmas news stories:

“the Federal government wrote off or forgave”…$10.2 billion in 2023 relating to “Ottawa’s pandemic-era emergency loan program for small businesses. The loans were either $40,000, of which $10,000 was to be forgiven, or $60,000, of which $20,000 was to be forgiven.” “The loans were to be repaid by Jan. 18/24 to have amounts forgiven.”

“Gig platforms will be required to report the name, date of birth, address and total income earned on the platform to the CRA [starting in Jan/25], Lemay said, provided the worker in question logged more than 30 ‘activities’ — which can be understood to be sales, trips, or assignments — on the platform and made over $2,800 on the platform during the year.

The second point is obviously a good idea, although the fact that the Liberal government waited until now to make this change seems worthy of note (see prior post “Liberals go hog wild on immigration, hoping to secure victory in 2029 and beyond” Aug 21-24). Particularly given the survey conducted by H&R Block, which found that “nine million Canadians are part of the gig economy. Of those, 43 per cent said they’d be willing to risk not declaring all of their income in an attempt to pay less in taxes.”

That’s a lot of people trying to keep their heads above water by cutting corners on their taxes. I had a enlightening conversation with one very active and cheerful airport limo driver recently, who supplements his chauffeur business with Uber rides when he has time. He said that having a business is great, “because you can write everything off.” As for paying taxes, “cash is gold, Uber is gold.”

We can all assume we know what that means. Babysitting money is one thing, but limo rides, when there’s expenses associated with the business in question?

Is it possible that there are nine million gig workers?!? With 41 million Canadians, but only 29.6 million between the ages of 15 - 69, H&R Block’s survey implies that 30.4% of working age Canadians participate in the food delivery / part-time server / contract dental assistant / freelance world. And how does that nine million figure dovetail with stats saying that small businesses employed 5.7 million individuals in Canada in 2022, or 46.8% of the total private labour force. That’s not quite the same thing as being self-employed, per-se, which ties into Fed stats showing 55% of Canadian businesses as being “micro-businesses” with 1 - 4 employees.

Speaking of “micro-businesses,” you may find it interesting that 360,000 small business jobs were “created” between 2021 and 2022, just as the Federal Covid loan program was launched. I’d hate to think that someone started a one-person University consulting business or got their real estate licence in 2021, incorporated a numbered company, and applied for a $60,000 Covid loan. Based on the terms of the program, it sounds as though this new businessperson only had to pay back $40,000 in January 2024 — despite the fact that their biz plan wasn’t negatively impacted by Covid.

Unlike a restaurant or small clothing shop, for example.

What percentage of the 2023 $10.2 billion Covid loan write-off was related to businesses that truly needed the capital to keep the lights on is unclear, but if you read this blog, each one of those 2023-vintage $10k & $20k gifts came from you.

When the Trudeau government increased capital gains taxes earlier this year, the pitch was that the estimated $7 billion of additional 2024 revenue that the increase was to generate was needed to keep the federal budget deficit below Ms. Freeland’s $40 billion target.

As we recently learned, that deficit is now estimated to be around $62 billion.

I suppose that’s better than $69 billion, but everything comes at a cost, and when an acquaintance’s artificial intelligence software start-up recently moved from Toronto to Austin, Texas, the reasons he cited were as expected (see prior post “How Freeland’s capital gains tax changes will harm Canada’s economic future” April 30-24).

As Canada stumbles into 2025, the signs are not good. Whether there’s an election in March or October, the complexity of the deep-seeded challenges before the new government are hard to fathom.

MRM

(note: this post, like all blogs, is an Opinion Piece)

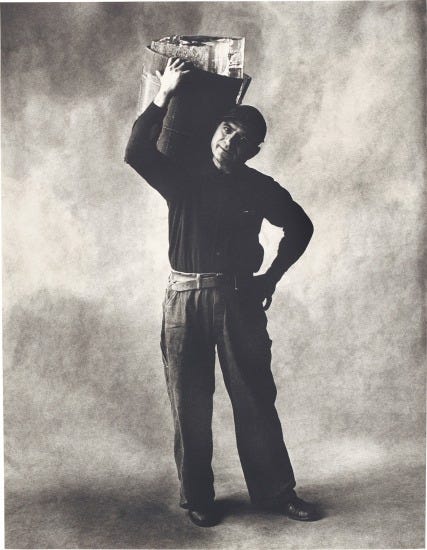

(photo credit: Iceman, New York, 1951 by Irving Penn)

Mark

So timely. I was thinking about writing something on this very topic after discussions over the holidays with two friends/co-investors who have decided to leave Canada. The tragedy is both love(d) being CDN, made the bulk of their capital as entrepreneurs in Canada, have been very active angel and fund investors, and have been very philanthropic engaging both their capital and time in a pretty wide swath of needed areas.

Having them leave Canada is a loss pure and simple. These are smart, successful, engaged people with the capital and demonstrated will and desire to give back and be impactful for less fortunate Canadians, and so their leaving is unnecessary loss that most definitely could have been avoided.

Investment likes certainty, which the Canadian government for the past ten years especially has not provided. I know a number of wealthy people who like the south, and it is only family and memories here that keeps them here, not our fiscal policies. Good that Mark is profiling this.