Montreal Startup Scene: it's either "invisible" or "the sun is shining"

A case study in how not to pitch Ottawa

“If you’re not in Toronto, you’re invisible,” according to the Government of Canada’s Deep Tech equity fund manager.

Given I’m a bit less plugged-in than normal at the moment, perhaps The Business Development Bank of Canada’s Thomas Park is on to something; far be it for me to question an industry colleague’s pearls of wisdom. That said, based on the negative reaction that his recent Globe & Mail Op-Ed piece generated within my Twitter following, I thought I’d have a look at the facts. Has Toronto, in the space of 20 years, come to completely dominate Canada’s venture landscape?

But before I could get into research mode, The Logic’s Martin Patriquin reported that “The sun is shining on Montreal’s startup scene.”

How can it be that Montreal’s startup scene is in a bright spot if entrepreneurs, VCs and their creations in that world class city are “invisible,” as the lawyer/MBA/MPA/VC Mr. Park would have us believe?

Mr. Park claims that Toronto-based firms attract more capital than every other major Canadian city combined, yet the CVCA’s Q1 2023 stats show that the largest round during the most-recently reported period went to Edmonton’s Jobber. In keeping with Mr. Patriquin’s narrative, the CVCA also reported that Quebec companies raised more capital than any other province in Canada. It’s only a single-quarter snapshot, but one thing is clear — money is finding companies that aren’t in the M-postal code. Alberta and Quebec, to name two key ecosystems, seem anything but “invisible.”

The cynical among you might think that Mr. Park is advocating for a larger capital allocation for his Deep Tech fund, as he goes on to lament that software attracts more funding than other sectors, that this is unproductive from a capital allocation standpoint, and that Toronto’s tech ecosystem is partly to blame for Canada’s weak productivity gap:

Unfortunately, Toronto’s tech ecosystem currently develops innovations that have marginal impact on Canada’s economy. It has mirrored Silicon Valley’s ecosystem, with a heavy focus on enterprise software targeting sectors that Canada has little strength in. Hardly any VC capital is invested in sectors that make up the bulk of companies on the TMX, such as those in the energy, basic materials, or advanced manufacturing industries. This is exacerbated by the fact that Canada’s sectoral strengths are located in regions outside Toronto, especially in Halifax, Calgary, and Saskatoon. Because Toronto’s tech ecosystem mirrors Silicon Valley’s, it’s no wonder foreign investors are so active in the city.

Meanwhile, Canada’s productivity gap – the ability of our firms to compete globally – is getting worse. According to numerous OECD studies, Canada consistently lags other countries in innovation output, especially in those sectors that dominate our economy. In manufacturing alone, we have one of the lowest adoption rates of robotics and technology. And the leading tech ecosystem in our country isn’t built to solve this.

The OECD point isn’t news (see representative prior post “"60 additional intern jobs" is not an Innovation Strategy” Apr 18-23), but what does the venture flow data say? The CVCA’s stats for 2022 show that the “industrial and manufacturing sector surpassed the information and communications technology (ICT) sector for the first time in 2022, with CAD $2.4B invested over 212 deals, while ICT received CAD $1.6B over 134 deals.” So much for VCs ignoring the Canada’s industrial and advanced manufacturing sectors.

Now, don’t get me wrong. I’m all for Crown Corporations pitching their political masters on various ideas. Perhaps not via an op-ed piece when your entity already has more than enough taxpayer capital at work ($21 billion!), but as someone who once toured Toronto’s editorial boards regarding a certain underwater tunnel idea, I understand the temptation. The question must be asked, though: is Mr. Park correct that i) VCs focus too much on Toronto, ii) there’s too much funding directed at Canadian software plays, and iii) Canada hasn’t been focused enough (I assume this includes both the Liberal government and BDC) on “building out the [existing] ecosystems” beyond Canada’s largest city?

We need to shift our priorities to building out the ecosystems outside Toronto, particularly in cities such as Halifax and Calgary. These are cities with many inherent strengths: strong R&D capabilities and competitive advantages in Canada’s economic strengths with local corporate champions that can help startups scale their products and services.

Government policies should begin to shift toward building out funds and platforms to support these ecosystems and encouraging talent to relocate to these cities. It means taking what worked for Toronto and developing it in other cities.

Last time I checked, Halifax was one of the Liberal government’s five Supercluster beneficiaries. If BDC’s idea is to leverage “local corporate champions” in Halifax, isn’t Ottawa’s “Ocean Supercluster” — with a 2035 target of $220 billion in market value — already supposed to be doing that? Unless, of course, the thought is that Halifax needs more local Seed and VC funds to help regional entrepreneurs turn their ideas into successful businesses; if so, I’m all for that. The ten year-old VCAP / VCCI program — that myself and others at the CVCA advocated for many moons ago (see prior post “CVCA letters to Messers Flaherty, Clement and Ignatief” Dec. 26-08) — is designed for this very purpose.

After a bunch of quiet years post-2008, Calgary has taken matters into its own hands on the startup front. The 2020-era Calgary Start-up Institute guide proves the point better than I ever could. In June 2022, Platform Calgary opened, bringing together hundreds of local and national investors, advisors and mentors. Would more local VCs funds help Alberta’s entrepreneurs get their ideas funded? Naturally, but this is where the chicken/egg question arises. If Alberta has always been 4th on the list of Provincial tech / life science / clean tech startup fundings, is that a function of the local entrepreneurs, the energy patch, the size of the population, the predilection of regional investors, or a lack of focus on the Province from both Ottawa and BDC?

The answer is usually that Alberta-based Angels are more likely to back energy entrepreneurs, just as Waterloo-based Angels stick to a different type of knitting (ICT). Can a new early-stage government program change that? Perhaps.

With billions of Federal Supercluster dollars flowing to cities that aren’t Toronto (see prior post “It's a ‘Cluster,’ alright” April 17-23), Mr. Park’s op-ed makes it seem as though the left hand (BDC) and the right hand (ISED) aren’t co-ordinated. Or, worse, that the Supercluster strategy is an abject failure, and folks are gearing up for some new Master Plan.

I’m not sure which is more troubling.

MRM

(this post, like all blogs, is an Opinion Piece)

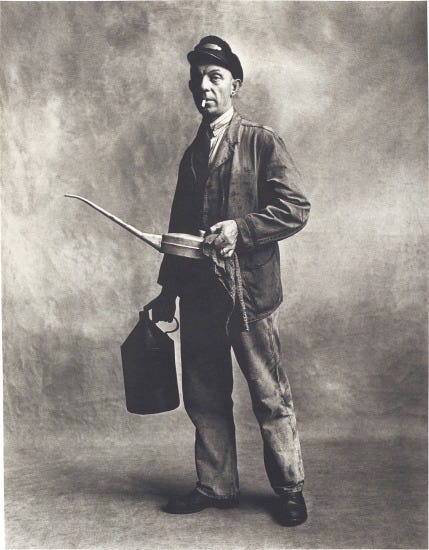

(photo: Engine Driver, London, 1950, by Irving Penn)

Great article. I hope the people in Ottawa read this.