News report: Rogers Communications to buy out Bell’s share of MLSE for $4.7 billion

In an effort to serve you younger I-Bankers out there, here’s your biz dev tip of the day.

Long before you entered high school, a combination of private equity and pension funds offered to acquire BCE (BCE:TSX) for $30 billion back in 2007. At the time, it was to be the largest LBO in history. There were two key deal consortiums — both of which were distinguished and had an ability to pay, as they say. BCE’s then-management team tagged OTPPB as the proverbial Black Hat, merely because the go-private was their idea, while the “friendly LBO group” reflected the Dream Team of the era (see representative prior posts BCE takeover – only a matter of time Mar 29-07 and BCE takeover part 5 Apr 17-07) :

This group will be led by the Canada Pension Plan Investment Board (CPPIB), the Caisse de dépôt et placement du Québec and Canada’s Public Sector Pension Investment Board (PSP Investments), who have signed a non-disclosure and standstill agreement with BCE on a non-exclusive basis. Kohlberg Kravis Roberts and Co. (KKR), a leading global private equity firm, has also signed the agreement and will join the Canadian-led consortium as a minority partner.

If you’d like more of the backstory, I wrote dozens of blog posts on that 18 month deal odyssey (see representative prior post “Forget the break fee, BCE Board should take $36 instead” Nov. 30-08). It was fascinating for a variety of reasons: drama, politics, >$250 million in deal fees, the works! The deal eventually fell apart right at the peak of the global financial crisis, likely to the relief of the banking syndicate.

And their regulators.

Plenty has changed in the telecom and cable industries over the past 16 years, and you’ll need a compelling thesis to convince your would-be Private Equity bidder that their firm will be able to surface value at BCE in the current competitive environment. Prior to yesterday, BCE shares looked like dead money for anyone other than an 80-year old Grandparent looking for a tax effective dividend stream. Shares are down about 10% YTD, and prior to yesterday’s news, the annual dividend handle was 8.5%.

What an enterprising I-Banker will recognize is that the proposed MLSE transaction just made your modelling work a bit easier. Without yesterday’s news, your BCE LBO pitch deck would have had to assume a certain “break-up value” number for MLSE. That would have introduced both risk, as to the eventual number that someone might pay, while also giving your prospective lending consortium one more thing to fuss about.

Thanks to Edward Rogers III, who served his own stakeholders extremely well through this once-in-a-lifetime transaction, no longer will you have to guess at what BCE’s 37.5% stake might surface. (I wish I had that luxury in 1994 when I was trying to figure out what Labatt Communications was worth, back when I had a great LBO idea, but neither capital nor experience.) Baring some calamity, BCE will be a lot less leveraged when Summer 2025 comes around, giving you plenty of time to get your ducks in a row. Leverage is what makes the numbers sing on any LBO, and with interest rates dropping over the next nine months, the forecast IRR should only improve. As to BCE’s current leverage profile, CG’s equity research analyst had this to say:

We estimate that with these proceeds BCE’s net debt/LTM EBITDA would be positively impacted to the tune of 0.4x. Our prior projections had BCE de-levering from 3.7x currently to 3.5x by Q2/25; this now eases to 3.1x upon closing. We also estimate EPS accretion of $0.11.

Although BCE is exiting this particular ownership position, they were able to negotiate a 20-year content agreement on their way out the door. Live sports is still the King of ad revenue, and I suspect the Leafs and Raptors will attract their usual audiences for the next two decades. That means that BCE’s media group, or at least the TSN division, will have a valuable revenue stream throughout the life of your DCF model. Another plus. (If you need help finding someone to take the TV assets off your hands, give me a call.)

Whether you think BCE can produce EBITDA of $9 billion or $11 billion in 2026, some combination of bank debt, senior notes and high yield might be assembled to get you to 5x leverage, up from the current forecast of 3.1x. I don’t see why the $1.5 trillion global private debt market won’t try to dazzle you with a stretchy proposal, but 5x closing leverage isn’t anything near crazy.

BCE is currently trading around 7.6x 2024E EBITDA, has no growth plan, and neighbour Corus is facing bankruptcy; offering a 15% or 20% premium might be all the BCE Board needs to sign a lock-up with your PE client.

Sounds like a good use of your time. Bonus season is coming, and there’s nothing like an exciting, proprietary project to remind your boss why he/she is lucky to have you on the team. You’re welcome.

MRM

(this post, like all blogs, is an Opinion Piece)

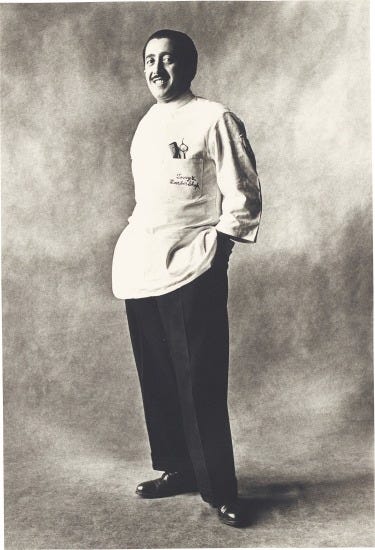

(photo: Barber, New York, 1951 by Irving Penn)

Notable that after a day to reflect and dig deeper into the news, BCE shares are now underwater vs the low of the day yesterday.