Five banks, two starkly different choices on racial equity audits

There's the easy way, and then there's the hard way. Which is which?

I wouldn’t have thought that Canadian bank CEOs and their Boards of Directors could wind up in two starkly different camps when it comes to “third-party racial equity audits,” but that’s exactly where things have landed, so claims a press release from a group calling themselves the Shareholder Association for Research and Education (SHARE). What does it say about the state of corporate governance and freedom of thought in Canada when highly experienced and considered people, in truly good faith, arrive at the opposite outcome on what may well have been the most difficult decision they’ve ever faced as a governing body?

According to the Atkinson Foundation, which you’ll know from it’s Toronto Star links, “historically and persistently, banks have exacerbated the racial wealth gap, through overt policies, and unconscious bias. Research has indicated that, when compared to their white counterparts, people of colour and Indigenous people are more likely to be denied loans, to be recommended products that were not properly serve their interests, or not offered crucial products at all such as overdraft protection and balance protection insurance.”

With that backdrop, SHARE is pushing shareholder resolutions at the upcoming bank AGMs, and CIBC and National Bank have joined TD Bank is agreeing to conduct and disclose the results of third-party racial equity audits. According to SHARE, the management proxy circulars issued by BMO and RBC “recommend shareholders vote against” such proposals.

Over the past 30 years, I’ve spent time as a teller, lending trainee and senior executive, and I can assure you that I saw nothing of this nature at either bank. If you run a Canadian FI and share my lived experience, it would likely be easy to agree to some form of “independent analysis of [your] business practices intended to identify and remediate potential and actual disparate outcomes for Indigenous people and communities of colour.” If your bank’s motto is “we believe in better,” you’d be hard pressed to arrive at any other decision.

Things get tougher for a bank Board when the audit’s mission statement warns that it is going to evaluate the merits of your institution's “efforts, policies and practices to tackle systemic racism.” If the auditor’s starting point is that banks have failed “to provide equitable opportunities to people of colour and Indigenous people,” which perpetuates “unequal wealth distribution,” you have to assume the auditor is going to find some form of systemic racism, whether or not that’s actually the underlying driver of a particular decision on any given day at a teller wicket or loan adjudication department.

By agreeing to an audit, it could be expected that a CEO’s goal was to confirm his/her own sincerely-held view that the bank in question isn’t systemically racist; but given the audit proponent’s frame of reference, it might be impossible to prove that negative. When the final report arrives on the CEO’s desk, describing even the appearance of systemic racism based upon numeric outcomes, you’ll then have to do something about it. Moreover, since the law of the land doesn’t permit a bank to take mortgage security over a family home on a Reserve, for example, you know going-in that you can’t provide “equitable opportunities” to many Aboriginal Canadians. Newcomers to Canada, a majority of whom are from communities of colour, don’t have a local credit history to lend against. Neither shareholders nor regulators look kindly on unsecured or unsupported lending.

To make things even more complicated, several of the banks in question are partners of Canada’s BlackNorth Initiative. BNI supports a wide variety of inventive approaches, including a “homeownership bridge program” to address a fundamental wealth-building opportunity where “the Black community has been left out.” According to BNI, “housing is highly racialized in Toronto”:

➢ 75% of residents who identify as white, have a higher than average income, and are homeowners

➢ while 69% of residents who identify as racialized, have lower income, and rent their houses.

Whether or not banks are the key culprit here is beyond my analytical capabilities, but every Canadian bank CEO and Board would have been aware of the public firestorm that might be generated if they rejected a public request for a racial equity audit; the classic “what have you got to hide?” situation. It’s all the more tricky when you’re a federally-regulated institution with a “woke” Prime Minister.

By recommending against the proposal, BMO and RBC are joining many of the large U.S. money centre banks (JPM, Citi, BoA, Wells and Goldman). They’re also arguably aligned with the views of many U.S. Republicans, including Strive Asset Management’s Vivek Ramaswamy, who penned a high profile letter to the Apple Inc. Board last fall:

Racial equity audits do not benefit the companies that conduct them. They are non-neutral evaluations designed to embarrass the companies who elect to conduct them, and there is no evidence to suggest that such audits increase shareholder value.

Mr. Ramaswamy’s CNBC appearances on “anti-woke investing” are so effective that he’s actually being discussed as a 2024 Presidential candidate.

For TD, CIBC and National, they’re more aligned with Blackrock and Morgan Stanley, for example, where some form of “internal diversity review” took place in 2022. Given Blackrock’s massive role in the global markets, it’s a naturally appealing beacon on issues of corporate governance.

As a shareholder of three of the six large Canadian banks, it’s fascinating to see my CEOs / Boards recommend such starkly different paths on what’s a passionate and high profile topic for so many stakeholders. Was the only obvious path to support SHARE’s proposed racial equity audit, or are a bank’s shareholders best served by not acquiescing to “progressive” advocacy on issues of “social justice?”

Apparently, one can go either way.

MRM

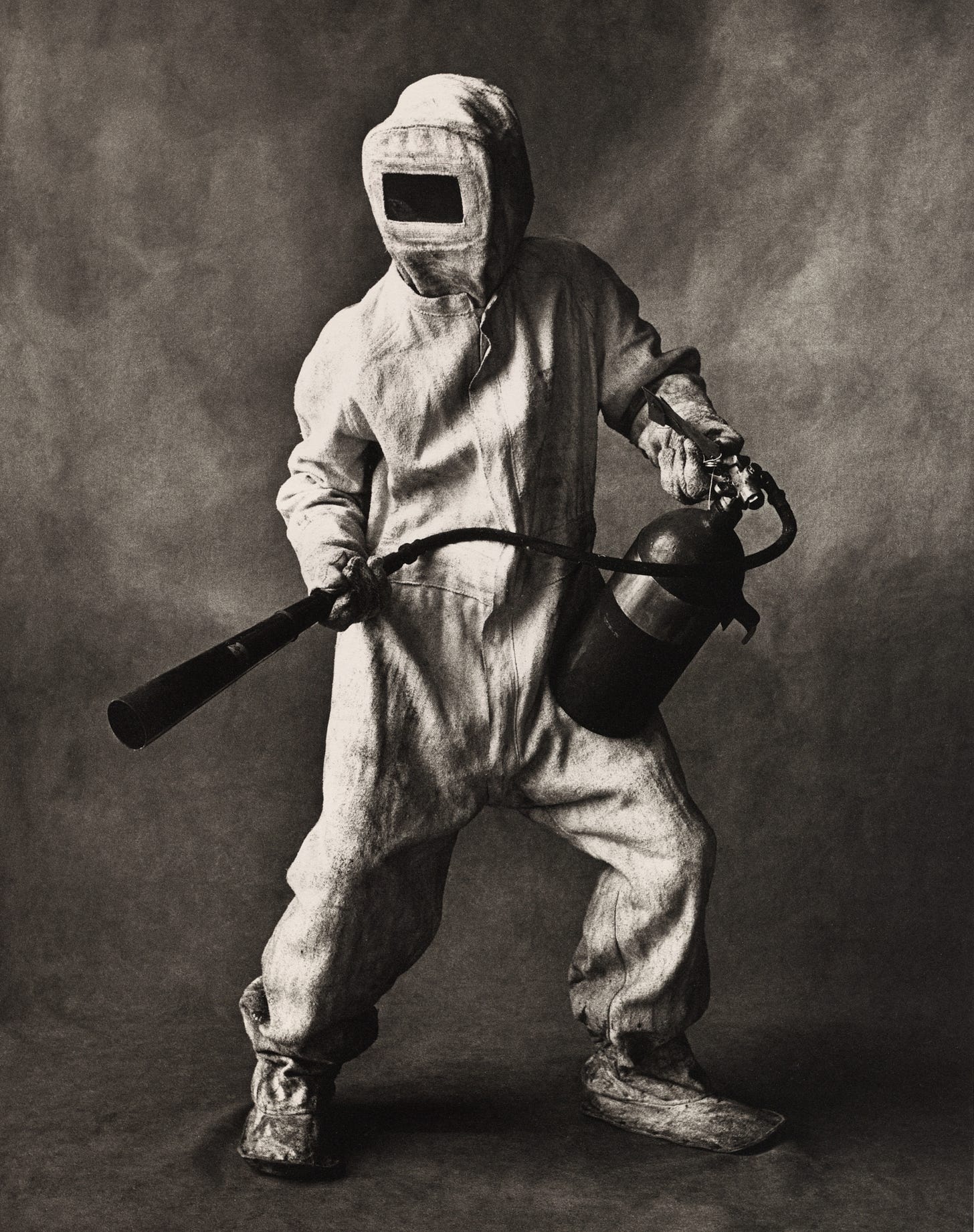

(this, like all blogs, is an Opinion Piece reflecting a personal view; photo by Irving Penn)

The strength of your written word deepens the legacy footsteps of thought provoking and insightful financial writing. Thank you.