It’s high time that I apologized to all of the Substack subscribers who signed up in 2023 thinking this new initiative would follow the well-worn path of my pre-CIBC posts. Although there were plenty of political-oriented blogs back then, the majority of stuff was either on the tech sector or the capital markets. Whether or not you could make money on those posts, at least you might have been better informed as an investor. (Several definitely helped you steer clear of losing money with Kevin O’Leary, but I digress {see representative prior posts “O'Leary ETFs already under-performing” Feb. 18-17 or Do O'Leary's "Low Risk" retail investors know they're long junk bonds? Apr 26-14}).

The chain of events following the Oct. 7th attack by Hamas has driven me to focus on “Canadian Values” and politics more than I had intended a year ago. Alas. I shall try harder over the balance of 2024 to serve my traditional readership.

Although large cap stocks out performed small caps by 12% in the first half of 2024 (source: Barclays), a recent pair of private M&A deals, along with Burnaby-based Clio’s incredible US$900 million equity raise, got me thinking about the state of play in the Canadian software space.

During the past few days, Toronto-based Pathfactory acquired Uberflip, while Vancouver-based Unbounce merged with San Francisco-based customer relationship management firm Insightly. These are normal outcomes in the private world, as VCs and management teams iterate along the long, winding path of value-creation. Prices and performance are kept under wraps, and everyone just drives on.

That’s not a luxury that public companies enjoy. We all get to watch things play out via the drumbeat of quarterly result press releases. For more than 25 years running, there’s been a pretty defined list of outcomes for every publicly-listed Canadian small cap tech stock:

It has success and grows to become a mid or larger cap stock (Geac, Kinaxis).

It treads water, perhaps experiencing some modest share appreciation over the years, until being acquired (such as Miranda and Workbrain).

The company muddles along for what will seem like an eternity for shareholders, with a regular stream of executive hires and departures (Mogo, Quarterhill).

It suffers execution challenges and falls into the arms of another entity, whether for strategic reasons (Jetform’s friendly takeover by Adobe) or tax loss benefits (such as OpenText’s purchase of Nstein for $35M).

Hits the wall.

We’ve seen a few takeovers over the past 36 months, but not as many as we might have expected. TSX-listed Sierra Wireless was acquired by California-based Semtech for US$1.2B. Early last year, Thoma Bravo bought Kitchener-Waterloo’s Magnet for $1.8B, with many of that firm’s existing big investors rolling into NewCo, just as things were starting to accelerate. With the ongoing absence of a Canadian IPO market, we are left with fewer names to choose from as local stock investors. And for the Tech i-bankers and traders, even less business than before.

Although those two names aren’t “small caps” in a Canadian market context, they’d have a hard time — given their market caps — getting on the radar of U.S. Equity Research Analysts following the initial public offering flurry. At home, however, they’re both examples of sufficiently large firms with access to external capital. And now they’re gone — at least for our investment purposes.

When you look across the current landscape, there are still a slew of names that seem interesting to me for a variety of reasons. They could’ve been high-fliers as a private that have yet to get much attention/traction as a newly-public co. The candidate might now be growth-challenged, and trudging along in the wilderness. Maybe it’s just a below-the-radar story. Certainly, sky-high valuations during the Covid IPO window haven’t done anyone any favours as things settled down over the past 24 months. Etc., Etc.

In 2004, there were very few buyers of these types of firms, beyond strategics or quasi roll-up types (Geac and Open Text). Constellation Software (CSU-TSX) wasn’t rolling just yet, and Enghouse (ENGH:TSX) wanted to pay, say, 3x EBITDA — making for a very small pool of public co. targets in that case. The hundreds of billions that are now available for PE-backed software go-privates hadn’t been assembled as of yet. And only a handful of VCs were prepared to play in the public market space.

How much has changed in 20 years! There’s now endless equity, and plenty of debt (both bank and private), available for good deals. Whether or not each of the names on the list below make for a good takeover candidate right now, investors might find them worth reviewing:

Calian (CGY:TSX) - Often overlooked, this 40 year old firm has spent 3/4s of it’s life as a public company. Calian pays a dividend (unusual) and has a decent following (seven equity research analysts) given the <$700M market cap. Shares are up >900% as a public company. The gross margins aren’t bad, and continue to expand. If pressed, it would be hard to describe the weird corporate tension between being a services play and a software story. That said, compared to widely-held Open Text (OTEX:TSX) for example, investors have done very well. As it’s neither a pure play nor a Fallen Angel with the potential for a turnaround, PE firms might not see an appeal here.

Coveo (CVO:TSX) - There were few hotter private Canadian software cos circa 2019, and Coveo was doing AI before it became table stakes. As with most COVID-era IPO names, shares sold off as valuations corrected. I bought some in August 2023, then again in January, March, and averaged down in May 2024. I didn’t tender into the $7.70/share substantial issuer bid, and now have the chance to average down at $6.50, once again. ;-(.

I’m a big fan of the company’s CFO, Brandon Nussey (more on him here), and am not worried about this ending well. This is just a chance for a gut-check, maybe.

Back in February 2023, Scotiabank’s Equity Research Analyst had this to say on the name:

Coveo Solutions reported Q3/23 results ahead of our and Street expectations along with management’s prior guidance on revenues and adj. Operating Loss. This marks the 4th consecutive quarterly beat on both revenue and adj. operating income. The company increased its FY2023E revenue and adj. Oper. Income guidance further as it saw continued expansion with new and existing customers while achieving further operational efficiencies.

We believe Coveo shares offer investors a way to benefit from the trend for organizations to provide all stakeholders with more relevant and timely information through digital search and relevance. We view shares as attractive overall based upon (1) ongoing strong growth and performance from a leading AI-based solution, (2) a resilient and diversified enterprise customer base, (3) strong progress toward profitability, and (4) an attractive valuation profile. We are adjusting our price target to $12.00/share (prev. $9.00/share), reflecting revised estimates and a 6.0x F2024E EV/Revenue multiple (prev. 4.5x), while maintaining a 1x premium to current SaaS peers based on higher expected growth.

Almost 18 months have passed since this report was issued, and I’d like to think the premise still holds, even if the “expected higher growth” has yet to play out.

Much more recently, CG published this Research note:

We lowered our target price to C$11.00 (from C$12.00), which now reflects ~4x (from ~5x) NTM+1 Sales. Coveo currently trades at 2.6x NTM EV/sales after giving effect to the SIB which we consider inexpensive for a company with Coveo’s potential strategic value as an enabler of GenAI and AI more broadly in the enterprise. We maintain a BUY rating.

D2L (DTOL:TSX) - This name has traded up in recent months, and last week’s takeover of Instructure (INST:NYSE) will draw new eyeballs. Like D2L, Instructure Holdings is a developer of a cloud-based learning management system (LMS). The latter has announced a definitive agreement with PE firms KKR and Dragoneer Investment Group. Although the deal is far bigger, at an EV of US$4.8B, investors seem happy with the implied multiples of 6.6x C2025E sales and 15.8x EBITDA. Buyers of the D2L 2021 IPO are underwater, but hope may be on the horizon; it’s just not clear if the Founder would sell just yet.

As of Friday, D2L was trading at 2.1x C2025E revenue and 14.6x EBITDA. According to the CG Research Analyst, “the acquisition of Instructure could provide opportunity for D2L to build on its share gain momentum in a market where both these players are having success replacing legacy solutions.”

By coincidence, The Logic’s Catherine McIntyre just published a piece on D2L CEO John Baker’s mindset at the moment: The education of D2L’s John Baker. The interview might help you navigate the company’s future.

Docebo (DCBO:TSX) - You might wonder why an Italian-based company went public on the TSX, but I’ll leave that to the Underwriters to explain. If Canada can be the global centre for mining finance, it seems only fair that we should draw software firms from Israel and the USA, for example. Right? But to draw from Italy and not the USA, for example, is just fascinating. This from CIBC Equity Research last month:

The average FY2 EV/Sales multiple across our coverage universe was 4.0x at the end of June, 0.1x below the two-year average of 4.2x and 1.4x below the five-year average of 5.4x. Roughly half of our coverage is trading below the respective two-year average. From a valuation perspective, we continue to like TIXT, which is trading at a 0.7x discount to its two-year average, as well as DCBO, which is trading at a 0.6x discount to its two-year average.

I’m not sure what to make of the fact that the stock’s been Dead Money for the past year, other than to say that the folks behind the story will want this to end even better than things have already gone for them. Which has been SPECTACULAR, in a word!

Kneat.com (KSI:TSX) - If you’re looking for a TSX-listed, Ireland-based software company, look no further! That’s perhaps partly why you might not have heard anything about the name; and to your detriment. I started paying attention to the story about three years ago as a potential CIBC Innovation Banking client, and as such was forced to miss out on the run from $2.30 to $4.50/share.

CanaccordGenuity took management on a roadshow a couple of months ago, and had this to say in the wake of those Investor interactions:

At the early stages of a significant market opportunity. Management speaks, we think conservatively, to a US$65M+ ARR opportunity with the current customer base of over 80 customers and an increased pace of new customer adoption.

Competition - When asked about the evolving competitive landscape, management continues to point to ValGenesis as the most relevant competitor, though Kneat speaks to a high win rate within larger pharma deals and has had success in competitive displacement. Veeva remains a notable new entrant with considerable scale, particularly as Kneat moves further into CSV, but is still relatively new to the validation market.

Kneat beat Q1 estimates with revenue of $10.8M, positive adj. EBITDA of $0.6M, and positive FCF inflection due to seasonal collections. The company ended Q1 with $37.5M in cash following the recent equity raise, and $21.0M in debt. Given high returns on investments in organic growth, Kneat remains in investment mode with a balance sheet to support it. Management confirmed it expects to selectively expand sales and marketing investments, particularly account management and customer success capacity, to support its high NRR (138% in 2023). With that said, it also expects to continue to gain leverage on gross margin, G&A and R&D spending, moving closer to breakeven annual FCF in the years ahead.

RayJay also covers the name, with an “Outperform.”

Quarterhill (QTRH:TSX) - To be honest, I’m not sure what happens here in the near term. A series of experienced managers have cycled through the corner offices over the years, and shareholder value creation has remained elusive. With a public market history that dates back to the dotcom boom, I suspect that each new strategy made sense at the time it was launched over the last 20 years; that nothing has worked so far, per se, and that the company missed Raymond James’ 2023 revenue target by $50 million (>25%), speaks to how challenging it must be for Institutional Investors to re-engage with long-in-the-tooth public company orphans.

Shares have been flat over the past five years, unless you were able to get off your position during the tech valuation excitement that pushed almost every name higher during 2020-21. Once a licencing story, the company is now focussed on the transportation vertical. This is what Raymond James had to say after Q1:

Good 1Q24. Fundamentals are improving with margins set to improve through the rest of F2024 as more tolling projects move into operational phase. We note renewed focus on Europe expansion opportunities (with recent boost from acquisition of software provider to tolling industry Red Fox) as well as a new “Logistics” segment which potentially could contribute material revenues in F2025.

Real Matters (REAL:TSX) - Although this name went public long before Covid-19, I bring it up given the expectation that lower U.S. interest rates should be good for the name in FY2025. At least that’s what the market seems to think, which is why shares are up about 15% YTD. This is a former Wellington Financial portfolio co., and shares got up to $32 when the stars were perfectly aligned in mid-2020. Whether or not a PE Fund would want to tackle this corner of the mortgage re-fi and appraisal market remains to be seen, but with a market cap. of just over $500M, it’s big enough to attract broad attention, and small enough to be in the strike zone of a few dozen funds and strategic buyers.

Thinkific (THNC:TSX) - I bought shares in May and June 2023. One institution kept puking out stock as I was building a little position, and I wondered if I had sized up the situation completely wrong. Once that selling ended, shares stabilized. Things started to turn around as the year progressed and I got a double, although growth will likely need to accelerate for the stock to move much higher from here. Which may well be a reason for someone to try to bid for it in the interim. Here’s part of a May 2024 note from CIBC’s Todd Coupland (he had a $5 target price at the time):

Revenue for Q1 was $16MM (vs. FactSet $15.9MM) while adjusted EBITDA came in positive at $0.2MM (vs. FactSet $0.3MM).

For 2024 and 2025, we forecast annual revenue growth of ~14%. ARPU growth from plan upgrades, upgrades to Pro+Growth plans and Payments adoption support this outlook. While we have assumed low growth in paying customers, this could change if market trends of upskilling attract Thinkific’s TAM to its highly effective platform. Our investment thesis is based on:

1. Large Market: The online education market is estimated to be worth $350B, with Thinkific’s addressable market pegged at 5.7MM content creators and 14MM SMBs (OECD, Thinkific). Adoption is low as Thinkific has ~35,100 paying customers as of Q1, reflecting 3% Y/Y growth.

2. Leading Platform: Thinkific provides a core operating system that is easy to use, attractively priced, and proven to help customers grow their business through online education. Content creators on Thinkific can make up to 40x more revenue per thousand views earned from branding or ads on social media platforms.

3. Conservative, Base Case Forecast: Assumes modest customer additions and ARPU growth. Our upside scenario assumes success with Leap, Plus growth from enterprise, broader payments adoption, and a higher take rate—all of which are increasingly more likely in 2024 and beyond.

VerticalScope (FORA:TSX) - With a mkt cap. of $180M, one has to wonder if this platform will want to stay independent for too long. Given TorStar’s relationship, I’m not going to pass along any further thoughts; here’s a recent note from CG’s equity research analyst:

While content licensing remains a meaningful upside factor for estimates, we think management will be more careful around crafting content licensing deals, and as a result, we are unlikely to see an announcement on this front in 2024. While the company continues to be in discussions with various platforms, management is assessing the longer-term impact of offering access to its valuable content for the creation of LLMs. As a result, we do not expect any revenue tailwinds from this area till 2025.

Back on M&A: Following an extended pause, management has resumed tuck-in acquisitions with a very small transaction in Q2.

Balance sheet de-levering picking up pace: The company closed Q1/24 with the leverage ratio of 1.8x net debt/LTM EBITDA, falling 400bps from 2.2x in Q4/23. Given the strong FCF trends and expected uplift in adj. EBITDA, we see this easing towards 1.5x in the upcoming quarters, depending on M&A.

Target and rating unchanged: We continue to value FORA using 8x EV/EBITDA 2025E. The stock trades at 6.1x EV/EBITDA 2024E and a FCF yield of 12%, even on our more stringent FCF definition. As the risk-rating eases, we expect upside to valuations of FORA. Notably, FORA is trading at lower EV/EBITDA multiples than every single one of its comps, including comps with sharply lower growth profiles. Hence, we believe there could be significant room for upside as the credibility around the thesis builds.

WELL Health Technologies (WELL:TSX) - If there was ever a time for “digital healthcare,” it would be now. Anyone who has interacted with Canada’s healthcare system this year will agree that more can be done to improve the patient experience, and modernize the doctor’s office and clinic universe. WELL helps with Telehealth, EMR, Billing and Revenue Cycle Management, ePharmacy, Digital Booking, e-Referral, e-Prescription, Workflow automation, and so forth.

A former Bay Street colleague of mine, Tom Liston, is a member of the Board of Directors; as such, I’m confident that shareholders have someone around the table who understand the need to deliver, over time. Whether that leads to a strategic sale to Telus (T:TSX), for example, a go-private, or ten more years as an independent public company remains to be seen.

CIBC’s Scott Fletcher published a research note last week; here a summary:

WELL is consistent when it comes to meeting quarterly expectations and has a track record of increasing its full-year guidance expectations with quarterly results. We are relatively in line with consensus, and see potential for an increase to revenue guidance, which traditionally does not include contribution from future acquisitions. WELL is up ~10% from where shares were trading prior to our January downgrade to Neutral, and is now in line with our $4.75 price target. We see shares as fairly valued at current levels, and remain comfortable with our Neutral rating.

There were a bunch of other names I could have addressed, but this will have to suffice for now. It’s too nice a day to be inside!

MRM

(note: this post, like all blogs, is an Opinion Piece; furthermore, I’m not licenced to give financial advice. This post is just to stimulate your thinking.)

(disclosure - we own shares of Coveo, Thinkific and Real Matters in our household)

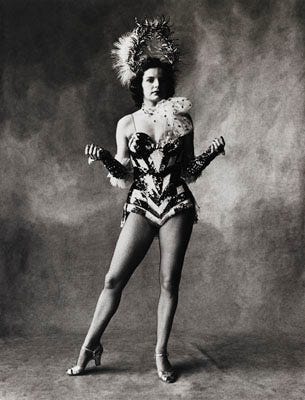

(photo credit: Rockette, New York, 1951 by Irving Penn)