It was just over a year ago that the business and political sections of many Canadian newspapers were filled to the brim with critical stories about Alberta Premier Danielle Smith’s plan to withdraw her Province from the Canada Pension Plan. I didn’t take sides in that debate, and tried to imagine the “likely visceral, political appeal of Premier Smith’s thought bubble” (see prior post “The political appeal of "Premier Smith’s plan to withdraw from CPP" -- whether we like it or not” Sept 28-23).

While we’ve all been occupied with summer holidays, back-to-school shopping, gnashing our teeth about the state of local traffic patterns and seeing the Canadian flag burned by faceless zealots, the Caisse de dépôt et placement du Québec (CDPQ) has been busy over the past 120 days doing its part to support some of that Province’s best-in-class firms. ICYMI:

Montreal-based National Bank (NA:TSX) secured a $500 million equity commitment in support of that bank’s strategic acquisition of Edmonton-based Canadian Western Bank

a $158 million growth equity investment in support of WSP Global Inc.’s (WSP:TSX) acquisition of POWER Engineers, a major U.S. consulting firm specialized in the power & energy industry

the lead order on a $575 million equity investment in Énergir, Quebec’s leading gas distribution company

a $378 million growth equity investment in Saputo, a huge producer of cheese and other dairy products

When Alberta’s world champion Canadian Natural Resources (CNQ:TSX) announced that it was “snapping up Chevron’s 20-per-cent interest in the Athabasca oil sands project earlier this month,” it was the Los Angeles-based Capital Group — a 19% shareholder in CNQ — that came out as the primary financial beneficiary (H/T Andrew Willis), not the taxpayers and retirees of that company’s home province.

Alberta Premier Danielle Smith must look at the breadth of CDPQ’s firepower — supporting local banking, infrastructure, energy and retail product juggernauts — with understandable envy.

MRM

(this post, like all blogs, is an Opinion Piece)

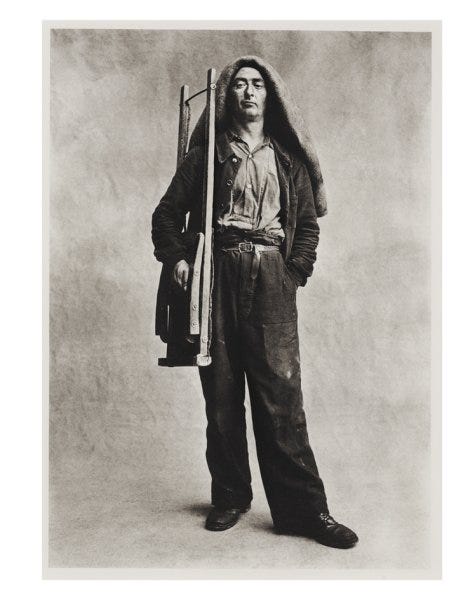

(photo credit: Charbonnier (B), Paris, 1950 by Irving Penn)

Caisse to sell off remaining oil assets by next year https://www.cbc.ca/news/business/caisse-climate-change-1.6191982#:~:text=Caisse%20de%20d%C3%A9p%C3%B4t%20et%20placement,footprint%20in%20half%20by%202030.

Also, the Caisse sold most of their energy holdings in 2021-2022. They were one of the biggest shareholders of CNQ, but 'proudly' sold in the $20-$23 range based on their filings.